The UK Market

According to the latest Rightmove Price Index report there has been an increase of 2.3% in the price of property coming to market this past month; and over 1.3 million buyer enquiries since election, which is up by 15% compared to the same period a year ago, to suggest there will be an active spring market ahead. There has also been an increase of 7.4% growth in the number of sales agreed this past month as sellers have acted quickly to beat the Spring rush.Furthermore there were almost 65,000 properties marketed between the 8th December and the 11th January, which is the largest monthly rise that Rightmove have ever recorded at this time of year. This suggests therefore that these new sellers are feeling a surge of optimism. The number of enquiries made to estate agents were also up by 15%, compared to the same period last year, to suggest demand was on the increase. This then led to a 7.4% increase in the number of sales agreed over the same period.

Whether this is a sign of the pent up demand being released will remain to be seen over forthcoming months but it does appear that some sellers have moved quickly as was anticipated over the Christmas and New Year period.

The Guildford Market

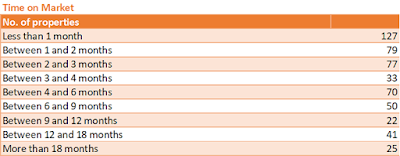

There were 23 additional properties added in the last 14 days mainly replacing those taken off towards the end of last year so have been relisted, and in some cases with a new agent in the expectation that they will have more success. Overall stock levels therefore remain constant although there do appear to be more detached properties currently for sale. The average asking price for this type of property has marginally increased too.The number of properties taken off market having been listed for between between 2 and 4 months might suggest that a number of offers were accepted towards the run up to the end of 2019. Alternatively this might also confirm the point above that vendors decided to de-list and then relist after the news regarding the General Election and the start of a New Year.

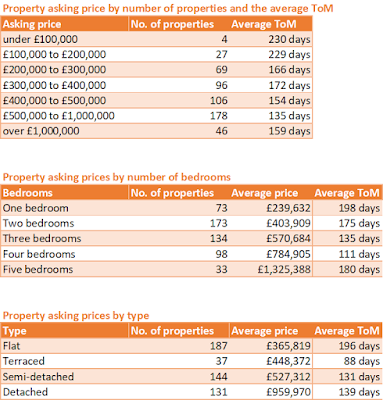

The average time taken to sell properties in Guildford over the last 90 days remains at 154 days, with half of the sales taking place within 78 days.

According to the latest data from Land Registry (available up until November 2019) approximately the same number of properties sold at a slightly higher average price of £498,595 in Guildford due to more detached properties being sold in the last month.

Having talked with local residents there does seem to be greater confidence in the market about the prospects for selling their property in the short term though one overriding comment made was that they feared how the growth of Guildford property prices in recent years will challenge those wanting to get onto the property ladder or to upsize. Having said this, many residents are sitting comfortably having decided to stay in their homes for the long term and experienced wealth that they could never have forecast at the time they purchased their home.

See you again soon for next month's property update to discover whether this initial feeling of optimism, that the New Year and the release of some of the pent up demand have brought, will be realised with a growth in property sales over the forthcoming months.

To request a copy of the latest Rightmove Price Index report featured in this update, please call 01483 320207 or text 07786 965631. Always happy to have a chat about the local property market too.