It is at this time of the year that we all look forward to changes for the better and one way to instigate these changes is to move home to create a new lifestyle for ourselves. It will therefore be interesting to see how the result of the General Election and the exit from Europe will boost house sales.

The UK Market

In their latest Property Index, Rightmove forecast a 2% price rise for the UK in 2020, now that there is a little more certainty following the General Election. Whether there is a pent up demand from the last 3 years of uncertainty remains to be seen. This may not appear until the Spring when listings typically increase as the days become longer.

They suggest that demand for property remains resilient but are understandbly worried about the lack of supply. The number of UK sales agreed so far in 2019 is down by just 3% on 2018, while the number of properties coming to market was down by 8%. There are several factors to suggest that the market should pick up. Interest rates remain low, lenders are competing to lend, there is high employment and wage growth is making housing a little more affordable.

The Rightmove report therefore expects the number of properties for sale will recover as more new sellers come to market to make up some of last year’s lost ground. However lower stock levels are likely to place an upwards pressure on UK house prices.

Another concern is that first-time buyers are still struggling to save a deposit to buy their first home. If they are unable to get a foot onto the first rung of the property ladder this will hinder sales further up the property ladder. Solving this issue would help to limit rising rents and increase transactions in the housing market.

The Guildford Market

Property stock levels in Guildford have continued to fall, whatever the type of property or the number of bedrooms, by 19%, compared to this time last year.

There has been a slight increase in properties available for sale over the last month, possibly due to sellers knowing the result of the General Election and therefore more confident that they will sell this year. A few properties that did not sell last year have been relisted in the past fortnight.

If one were to look back at the year 2007 (pre-credit crunch) the change in stock levels compared to then are even more significant.

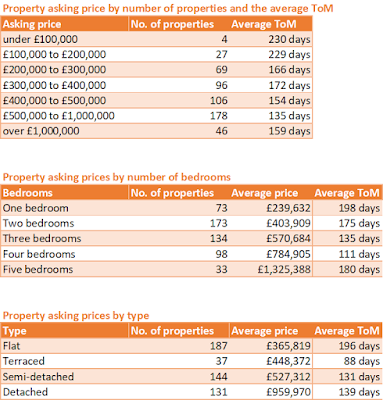

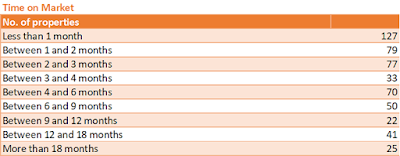

The time that vendors leave their properties on the market continues to increase though it is interesting to note that the number of properties spending between 1 and 2 months on the market (whether they sell or not) has decreased. This might suggest one of two things. Either the vendor was

curious to know whether their property might sell and so was a speculative listing; or more importantly they managed to sell.

The average time taken to sell properties in Guildford over the last 90 days has been 154 days, although half of the sales did occur within 78 days.

Asking prices have continued to increase over the past month by between 1-2% ... but have sales prices also increased?

According to the latest data from Land Registry (available up until Oct 2019) over the last 12 months there was a slight decrease of 1.4% for all properties in Guildford. Detached fell by 0.9%; semi-detached by 0.5%; terraced by 1.1%; and flats by 3.7%.

Is this because agents have been over confident in their original valuation, as suggested by the number of properties on the property portals, with reduced prices; or have buyers had success in negotiating prices down? This confirms again that prices can only be determined by what the market is prepared to spend.

See you again soon for next month's property update when we expect to see further certainty assuming there is progress in the BREXIT negotiations; and an increase in property listings now that owners have returned to normality after the festive season.

To request a copy of the latest Rightmove Price Index report featured in this update, please call 01483 320207 or text 07786 965631. Always happy to have a chat about the local property market too.